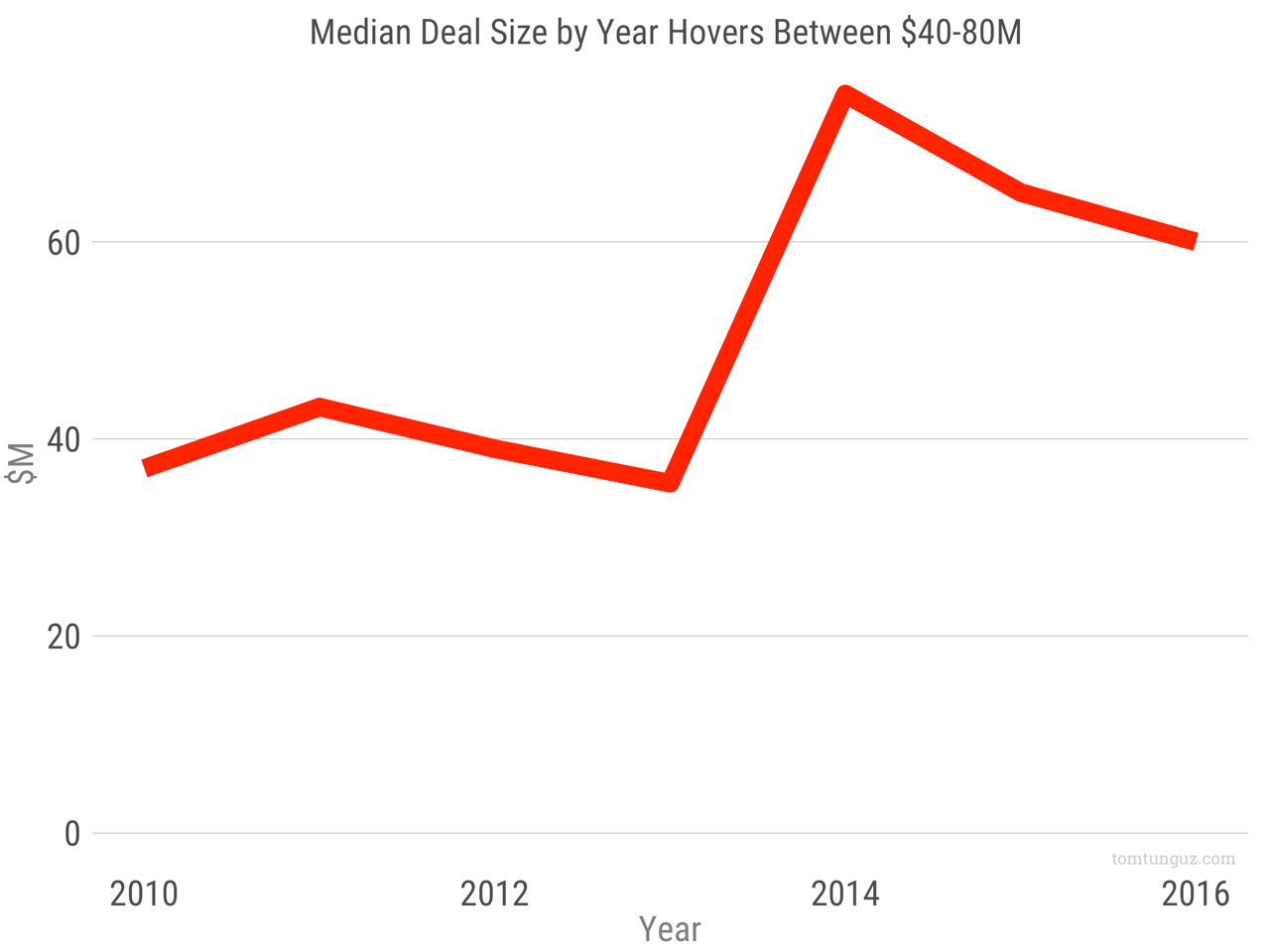

While most VC’s will tell you that they want to focus on startup shooting for the moon and selling for $1B+, the data shows that even selling for $100M is not the norm. In fact, over the last few years the median acquisition price of a software startup has declined from $80M in 2014 down to $60M in 2016 according to data posted on popular VC Tomasz Tunguz’s blog:

(Source – tomtunguz.com)

Of course it’s easy to say that a billion dollars is the place to be, and make it sound downright normal since the average deal size is getting closer to a billion every year. The reason for this is that the big, juicy, monster deals, are getting bigger. Companies selling for $10B, $20B and even as high as $29B are bringing up the average and making to seem like we’re in some kind of magical unicorn playground.

So while a billion dollars might sound great, don’t let anyone fool you into thinking that most successful software companies sell for a billion dollars…take a zero off the number and you’re still about $40M north of the median.