I’ll be honest, as a founder, when I pitch a VC I prefer a meeting longer than thirty minutes. It takes time to do a deeper dive into what we’ve put our blood, sweat and tears into. That being said, I started angel investing a little over three years ago and, well, I learned that as an investor I prefer shorter meetings, especially for my first meeting with a founder.

The reality is, we are all busier than ever with meeting, and thanks to our new culture of all Zoom, all day, every day and Zoom exhaustion is a real thing. If I meet someone in-person half an hour can fly by, but over Zoom, well, time just moves slower, or maybe that’s just me 🤷♂️

At the end of the day, there’s one philosophy that has really stuck with me over the years when it comes to pitching investors and that’s Mark Suster’s idea of lines not dots. If you haven’t read about this before, here’s a quick review:

The first time I meet you, you are a single data point. A dot. I have no reference point from which to judge whether you were higher on the y-axis 3 months ago or lower. Because I have no observation points from the past, I have no sense for where you will be in the future. Thus, it is very hard to make a commitment to fund you.

For this reason I tell entrepreneurs the following: Meet your potential investors early. Tell them you’re not raising money yet but that you will be in the next 6 months or so. Tell them you really like them so you want them to have an early view (which is what all investor’s want). When you’re with them lower the bar by telling them, “we haven’t shipped product yet, we have lots of decisions still to make, but we’d like to show you our prototype” or obviously if you’re more advanced show what you have and what your roadmap looks like.

Most importantly tell them what you plan to achieve by the next time you see them. Hopefully by then you’ve made good progress. You’ll be able to give them an update on key hires, pilot customers, key tech innovations — whatever. Keep these interactions low-key and short. Quick coffees, whatever. Swing by their offices to make it easy for them to say yes and promise not to take up more than 30 minutes for the update (and stick to it).(Source – Both Sides)

When you’re first meeting with an investor, the goal really isn’t to give them the world’s most convincing pitch so that after that they immediately send over a term sheet or write a check. Instead, the idea is to build a relationship and yes, that can start with a thirty minute call.

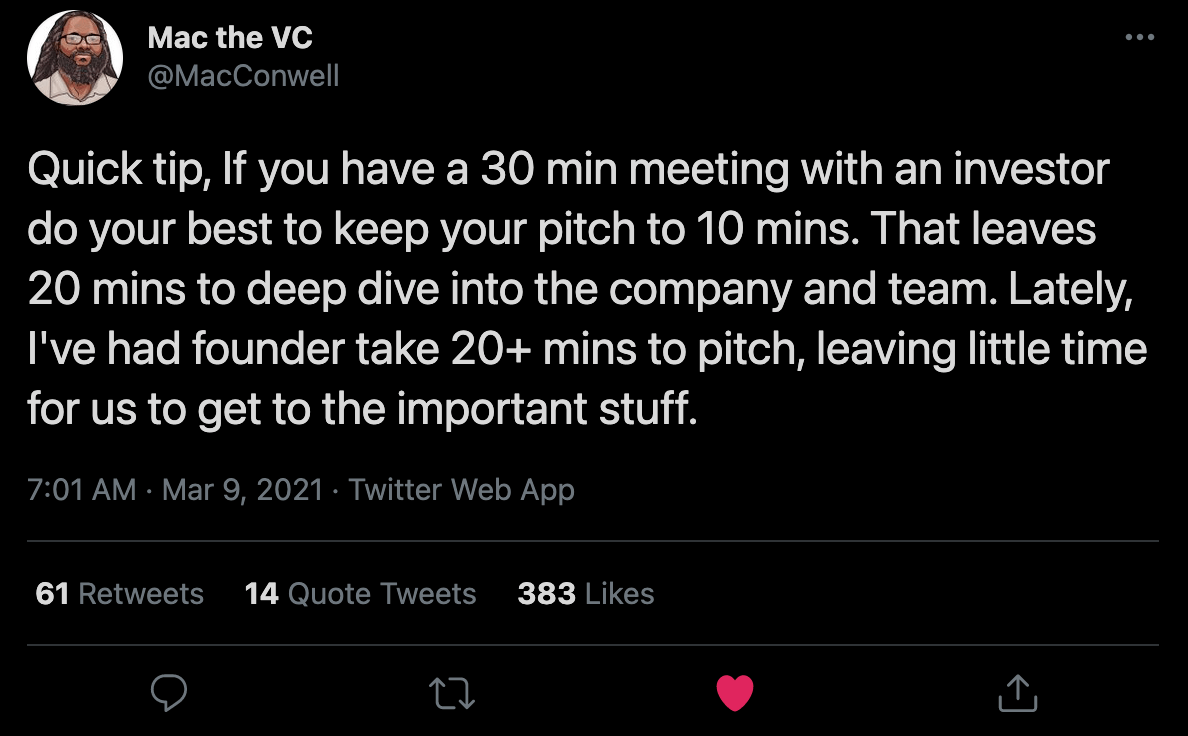

But how do you structure your time during that call? Today on Twitter one of my favorite VCs, Mac Conwell shared some really good advice that I think all founders should read and take to heart:

I wish I read this years ago. I can still remember pitching VCs for our Seed round and finishing our deck with three minutes left in our call and asking, “so any questions?” At the time I thought – darn, we didn’t have enough time to really get to know each other and have a dialog. Now I realize, we did, we just didn’t structure the time properly.

Thanks to Mac for sharing this, now can we just build a time machine so I can read this a bit earlier?